Großwald Curated | No. 17: Europe’s Unready Rear—Manpower, Mobility, and Strategic Drift

April 20–27, 2025 | NATO & European Defense – Europe’s Weekly Briefing. Curated for Policy, Intelligence, and Defense Communities in NATO / EU.

Europe’s rear is unready; deterrence credibility now hinges less on fresh equipment buys than on the ability to mobilise, scale, and sustain forces while under hybrid pressure and erratic trans‑atlantic signals.

A widening Dual‑Axis Readiness Delta defines Europe’s constraint.

This is a curated dispatch from the front lines of Europe’s defense pivot.

The Dual-Axis Readiness Delta.

| Axis | New Driver | Illustrative Signal |

|---|---|---|

| Personnel | Legitimacy of compulsory service |

Parties in Berlin re-open the draft debate; Warsaw flags reserve-force shortfalls; Budapest touts “defensive patriotism.” Der Spiegel / ZDF (21 Apr); FAZ (24 Apr); AboutHungary.hu (25 Apr) |

| Equipment | Paradoxical Cash-flow stress at tier-two suppliers |

Insolvency of armor-plate maker Urban Industries despite Germany’s €100 bn fund, NATO's ~$1 bn Innovation Fund & VC inflow for defense startups. T-Online (27 Apr); Handelsblatt (24 Apr); Der Spiegel (26 Apr) |

The Delta now burdens most NATO members. Unless capitals unlock SME liquidity, scale region-wide training, streamline certification rules, and expand rail-and-port throughput, it will continue to widen through summer 2025.

This Week’s Structure

I. Mobilisation Stress

– Personnel legitimacy & conscription politics

– Civil–mil lift chokepoints

– Regional readiness snapshots

II. Industrial Asymmetry

– MGCS Armour reset contest

– SME liquidity crunch

– VC surge in autonomy & UAV

– IRIS‑T SLM regulatory drag

III. Strategic Dislocation

– Hungary’s dual line

– European optics & sentiment

– U.S. policy whiplash

– DEI & regulatory clamp‑downs

– Visa‑harassment & surveillance‑privacy clash

– J.D. Vance's Ramstein Signaling.

IV. Maritime & Grey‑Zone Front

– Baltic sub‑shadowing & sabotage

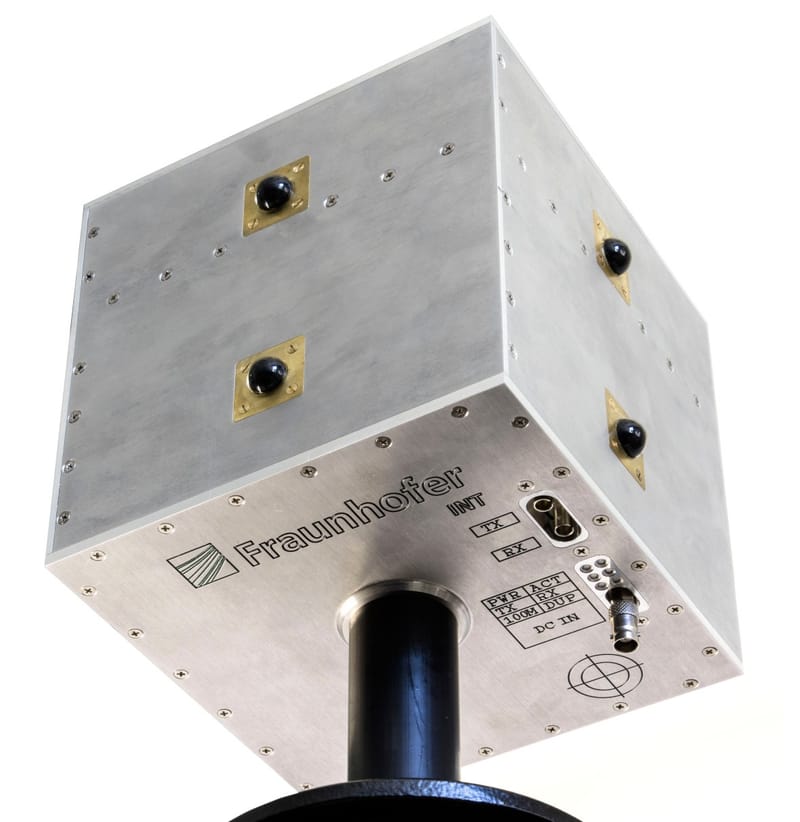

– Counter‑UAV doctrine

– Hybrid border pressure

– Minsk‑Doha drone protocol

V. Outlook — Next 14 Days

– Conscription blueprints

– Hybrid‑Toolkit 2.0

– Procurement‑Acceleration II

– Iran‑E3 channel

– Host‑nation‑support costs

I. Mobilisation Stress

Personnel Legitimacy. Berlin has re‑opened the draft debate, with CDU deputy Wadephul and Green premier Kretschmann floating a phased compulsory‑service model (Der Spiegel/ZDF 21 Apr; Tagesspiegel 22 Apr). Warsaw simultaneously admits that its rotational‑reserve construct is generating manpower shortfalls (FAZ 24 Apr), while Budapest couples a potential F‑35 acquisition to a public drive for “defensive patriotism” (AboutHungary.hu 25 Apr).

Civil‑Military Chokepoints. Rail load‑tests by Deutsche Bahn exposed a single‑line dependency for heavy artillery moves (Tagesschau 26 Apr); Lufthansa is negotiating to reallocate pilot‑training slots toward strategic airlift (Handelsblatt 22 Apr); and the city‑state of Bremen is lobbying for more than €500 m to widen its quays for NATO throughput (RND 22 Apr).

Regional Readiness Signals

- Northern flank. Lithuania’s Iron Fortress proved 7‑nation interoperability; GRU link to 2024 parcel bombs in Leipzig, Birmingham, Warsaw confirmed (RND 23 Apr; WDR/NDR/SZ 23 Apr).

- Central & Eastern Europe. Poland keeps Belarus crossings shut; Latvia drafts Schengen arrival declarations for Russians/Belarusians; Hungary accelerates rearmament (Euroradio 22 Apr; Belsat 24 Apr; AboutHungary.hu 25 Apr).

- Southern tier. 10‑nation fighter drill in Abu Dhabi (Tornados, Rafales, FA‑50s, UAE F‑16s) signals Mediterranean focus on coalition air dominance (Die Welt 26 Apr).

Outcome: Public legitimacy plus rear‑area lift capacity—not budgets—set the ceiling for Europe’s force‑generation sprint.

II. Industrial Asymmetry

Armour Reset. Franco‑German MGCS company finally launches after 12‑year impasse; Warsaw & Rome lobby to inject turret & APS IP (Kölner Stadt‑Anzeiger/T‑Online 21 Apr).

Liquidity Knots. Armour‑plate SME Urban Industries files insolvency despite Berlin’s €100 bn fund—mirrors tier‑two stress across CEE (T‑Online 27 Apr).

Venture‑Capital Surge. Munich leads 2024 defence‑tech inflows to ARX Robotics, Helsing, Tytan; NATO Innovation Fund (~US$1 bn) backs Alpine Space & Vsquared (Handelsblatt 24 Apr; Der Spiegel 26 Apr). ARX CEO Wietfeld: “Traditional weapons only work when massively meshed with autonomy.”

Regulatory Friction. Germany’s only IRIS‑T SLM battery sidelined for crane‑certification paperwork—echo of Puma IFV environmental hold (T‑Online 27 Apr).

Outcome: Capital exists, but certification and cash‑flow bottlenecks throttle deployment rates.

III. Strategic Dislocation

European Optics

Hungary’s dual line. Orbán decries “war psychosis,” yet Defence Minister Szalay‑Bobrovniczky touts pre‑emptive modernisation and F‑35 orders (AboutHungary.hu 25 Apr).

European Optics & Sentiment. All Visegrád leaders attended Pope Francis’s funeral, while Germany’s incoming Chancellor Merz stayed home to form his cabinet—interpreted as a north–south value split (Vatican pool list 26 Apr). Meanwhile, Eurotrack polling shows publics from Spain to Sweden still reject national nuclear arsenals even as U.S. guarantees grow less automatic, with Germany’s rejection rate at 49 % (Die Welt 25 Apr).

Transatlantic Relations

U.S. Policy Whiplash. “Crimea‑for‑peace” leak (23 Apr) dies after Sen. Rubio skips London talks; Paris‑Berlin‑Warsaw explore Patriot/NASAMS/Taurus coalition minus Washington (Tagesspiegel 23–25 Apr; Deutschlandfunk 24 Apr).

DEI & Regulatory Clamp‑Downs. U.S. regulators quietly press German firms such as Deutsche Telekom and BMW to drop DEI programmes; T‑Mobile US complied, reportedly linked to Lumos‑acquisition approval (Focus 24 Apr).

Visa‑Harassment, Surveillance, Privacy. A spike in Germans denied entry or detained at U.S. airports despite valid visas triggers Bundestag protest; CDU’s Wadephul calls incidents “unacceptable” (ARD Tagesschau 24 Apr). U.S. Travizory AI trawls tourists’ social media; EU interior ministers plan collective risk‑assessment review (RND 24 Apr).

J.D. Vance’s Ramstein Signaling. VP J.D. Vance’s Ramstein beer‑pour + neo‑reactionary riffs cement perception of transactional U.S. defence & punitive trade (Die Welt; Der Spiegel 26 Apr). Ramstein is the nerve center of U.S. military presence in Europe.

Outcome: Dislocation accelerates as national optics, sentiment, and transatlantic relations shake—Europe’s political and readiness asymmetries are exposed.

IV. Maritime & Grey‑Zone Front

Baltic Grey‑Zone Lab. Russian submarine shadowing now daily; U33 skipper Nestler confirms contact logging "every single patrol"; sabotage probes at German shipyards; Navy chief Kaack: “They are testing us” (FAZ 26 Apr).

BALTOPS 25 & Counter‑UAV Pivot. BALTOPS 25 sails from Rostock with 30 warships + U.S. carrier; drone‑defence plan remains unpublished amid Mecklenburg UAV sightings (Tagesschau 27 Apr).

Hybrid Border Pressure. Lithuania details Russian‑Belarusian campaign inciting “Litvin” violence; Latvia drafts new entry‑declaration rules (Belsat 24 Apr).

Minsk-Doha Drone Protocol. Belarus signs UAV‑co‑operation protocol in Doha, adding Gulf vector to sanctions‑evasion (Belta 24 Apr).

Outcome: Fragmented national measures leave exploitable seams until an EU‑wide hybrid‑threat code emerges.

V. Outlook — Next 14 Days

Conscription blueprints expected in Berlin and Warsaw; Budapest may lengthen volunteer contracts.

EU hybrid-toolkit revision likely before BALTOPS; focus on sanctions bypass and UAV threats.

Procurement-Acceleration II draft lands in Bundestag; Paris and Prague prepare parallel fast-track bills.

Iran–E3 contact resumes; European bandwidth depends on Ukraine file congestion.

Host-nation-support costs enter debate after Vance’s Ramstein visit; Berlin, Rome, Madrid anticipate higher U.S. asks.

Unless capitals unlock personnel, logistics, and regulatory knots, the Dual-Axis Readiness Delta will continue to widen—Europe’s core constraint for summer 2025.

| grosswald.org | All sources attributed in‑line

Großwald Editorial — follow the data, not the noise.