Inside Berlin’s Taurus Deadlock: Why Germany’s Most Powerful Missile Stays in Berlin—Not Kyiv

Long-range, high-impact—and withheld. Germany’s Taurus missile could help Ukraine strike deep into Russian territory, but Berlin won’t send it. This is the story behind Berlin’s missile dilemma—and the decision Friedrich Merz says he’s ready to make.

Strategic (Doctrinal) Gap –How, when, and where do we use Taurus? - This is the playbook problem: Germany is still debating the formal concepts, rules of engagement, escalation ladders, and command chains that would govern deep‑strike weapons like Taurus.

Political Will Gap – Do we act—or export—at all? This is the decision‑maker problem: even if a doctrine exists, elected leaders must still judge the risks, domestic politics, and alliance optics before they authorise use.

Keeping those gates separate explains how Berlin can be busily modernising Taurus (closing the capability gap) while still hesitating to send or employ it. The sections that follow use this lens to show where each gap shows up—and why closing only one of them isn’t enough.

In recent weeks, the long-running discussion surrounding whether Germany should supply Taurus cruise missiles to Ukraine has intensified again—this time in a changed political environment. Outgoing Chancellor Olaf Scholz (SPD) had repeatedly refused to send these long-range weapons.

Friedrich Merz, the likely incoming chancellor and leader of the CDU, has publicly reiterated his support for a potential Taurus delivery, provided that European partners coordinate such a move. Merz’s stance, coupled with a broader European arms supply to Ukraine, has reignited a controversial debate in Berlin.

At the very moment Berlin debates whether to export Taurus, it is heavily investing in the missile’s modernization and integrating it into Germany's next-generation defense doctrines. Such dualities—caution and modernization, fear of escalation and pursuit of advanced military technology—form the heart of Germany’s dilemma. Germany’s cutting‑edge arsenal now outpaces the doctrinal clarity required to wield it. Put simply, Berlin fields greater firepower than it has the conviction—or doctrine—to use.

Merz, a fiscal conservative with a background in corporate finance and a former chairman of BlackRock Germany, now represents a more assertive vision for European security—one that places greater emphasis on deterrence, industrial modernization, and alignment with NATO’s evolving posture.

His latest remarks were rather clear: Merz intends to supply Taurus to Ukraine. Also defining a first potential target: the Kerch Bridge.

Below, we outline the key facts, figures, and arguments that have propelled the Taurus missile into the center of Germany’s defense and foreign policy discourse.

Großwald Curated - Part I: Taurus Missiles and Germany's Doctrine Gap

Germany's Doctrine Gap: The disconnect between Germany’s defense capabilities and its willingness (or doctrinal clarity) to use them, particularly in contested or escalatory scenarios.

/ The Strategic Doctrine Gap: Capability Without Commitment

- Germany is modernizing its long-range strike capabilities—Taurus production is expanding, upgrades are underway, and future integration with Eurofighter platforms is in progress.

- These steps suggest Berlin is preparing for high-end warfighting: deep-strike missions, networked targeting, and coalition operations.

- However, Germany continues to withhold Taurus deliveries to Ukraine, even as allies like the UK, France, and the U.S. provide comparable systems.

- Berlin has not articulated a public doctrine that explains when or how such capabilities would be used—especially in alliance contexts like NATO or in response to escalatory scenarios.

Doctrine Gap: Germany’s military tools and industrial plans are advancing—but without matching strategic clarity or political authorization for operational use.

/ The Political Doctrine Gap: A Divided National Strategy

- Chancellor Scholz’s refusal to deliver Taurus and Friedrich Merz’s declared support reflect fundamentally different visions of deterrence, escalation, and German responsibility.

- There is no shared national doctrine uniting Germany’s defense modernization with a clear operational or foreign policy framework.

- While NATO posture evolves toward more assertive deterrence, Germany’s internal political, legal, and historical constraints continue to delay alignment.

Doctrine Gap: The Bundeswehr’s tools and planning are evolving faster than the political doctrine—and national consensus—governing their deployment.

Großwald Curated - Part II: System, Strategy, Stalemate: The Facts Behind Berlin’s Taurus Missile Controversy

/ 1. Taurus: A High-Precision Cruise Missile at the Center of Controversy

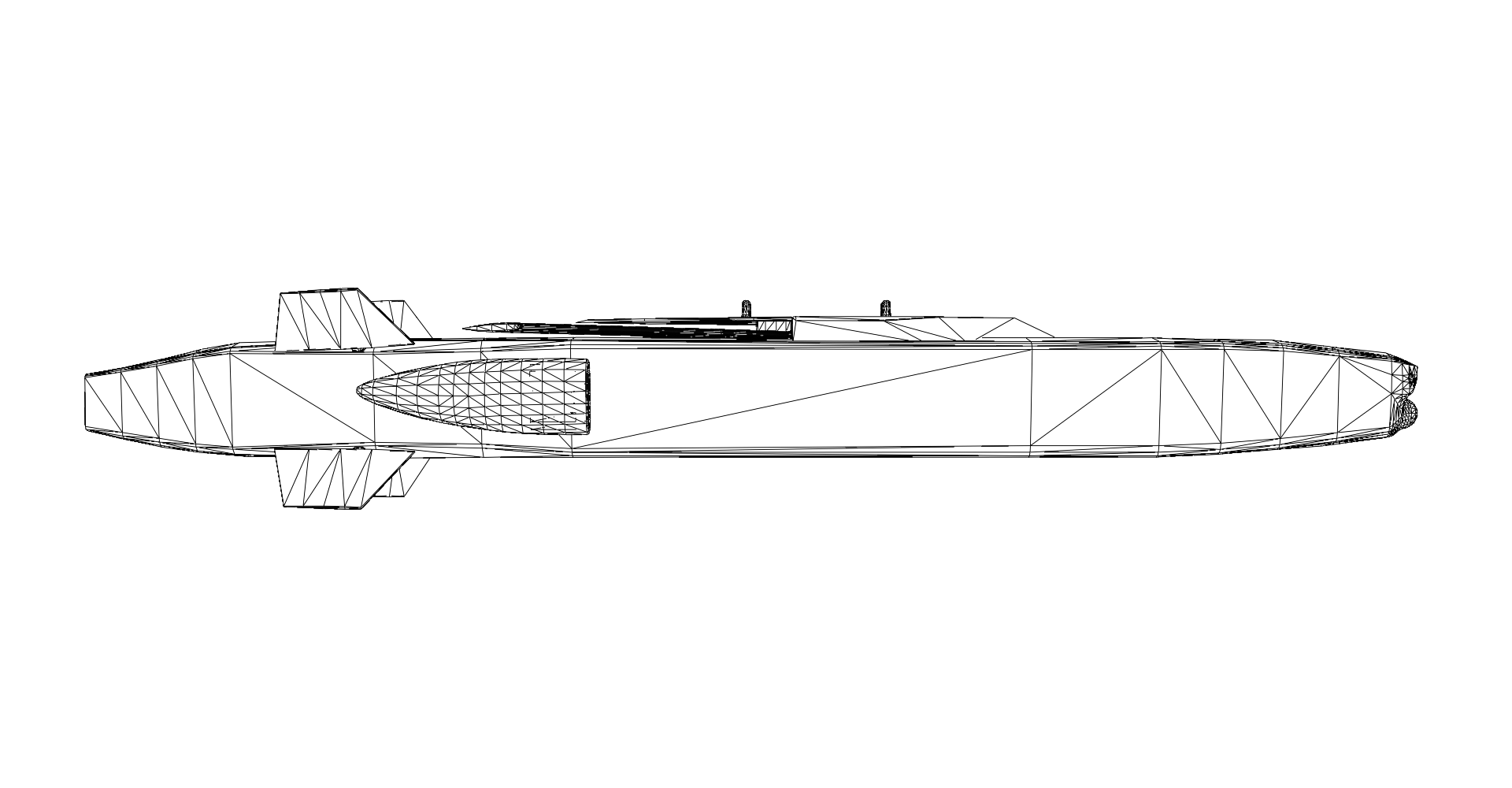

Originally developed by MBDA Deutschland and Saab Dynamics in the early 2000s, the Taurus KEPD 350 is a high-precision, air-launched cruise missile designed for penetration strikes on heavily fortified structures.

Measuring over five meters in length and weighing around 1.35 tons, the Taurus utilizes a two-stage warhead:

- An initial “shaped” or “opening” charge creates a breach in fortified walls or bunkers.

- A main penetrator then pushes through to detonate deep inside the target.

/ How Far Can a Taurus Missile Reach?

While the Taurus' maximum range is officially classified, most open-source defense analysts—including Gustav Gressel of ECFR—estimate an effective range of 400–500 km, putting high-value strategic targets well behind enemy lines, potentially including sites deep in Russian territory.

Strategic targets such as the Kerch Bridge or key Russian logistics depots are well within potential reach.

It surpasses the British Storm Shadow, whose stated range exceeds 250 kilometers, and the U.S. ATACMS with an estimated range of 300 kilometres.

/ Can Taurus missiles reach Moscow?

In theory, yes—but in practice, highly unlikely. The Kremlin—the “center of Russian power”—is around 450 to 500 kilometers from Ukraine’s border, placing it at the edge of the missile’s cited range. However:

- Launch Requirements: Taurus is fired from combat aircraft such as the Su-24 or F-16, both of which Ukraine is now operating or plans to field.

- Operational Risks: Pilots would have to approach or enter Russian-controlled airspace to launch. Russian air defenses and fighter patrols would pose severe threats to such missions, making a direct strike on Moscow risky both militarily and politically.

Escalation Concerns: Hitting the Russian capital would inevitably be seen as a major escalation—one reason Scholz has been hesitant to authorize these weapons - quo vadis, Friedrich Merz?

/ How Much Does a Taurus Missile Cost?

While the Taurus Systems GmbH keeps its pricing under wraps, investigative reporting suggests that in October 2024, then-Defense Minister Boris Pistorius planned to purchase 600 Taurus missiles at a total cost of EUR 2.1 billion. This baseline implies a unit price of roughly EUR 3.5 million. However, experts suspect that figure includes maintenance and related services, and they estimate the pure “per missile” cost could be in the ballpark of EUR 1.75 to 2 million.

TL;DR:

- 600 units = €2.1 billion

- Per missile cost (base): ~€1.75M–2M

- With services included: ~€3.5M each

/ How Many Taurus Missiles Does Germany Have?

Exact figures remain a matter of debate. According to one CDU defense expert, Roderich Kiesewetter, around 150 units may be operational as of April 2025. Another media report suggested about 300 are “potentially deployable.” It is unlikely, however, that Germany would offer its entire stock to Ukraine under any circumstances. The broader context: Britain and France have already delivered Storm Shadow/SCALP missiles, while the United States reportedly supplied Ukraine with hundreds of ATACMS missiles.

/ What makes Taurus different from Storm Shadow or ATACMS?

Longer range, heavier payload, and dual-stage penetration warhead. It surpasses both the British Storm Shadow, and the American ATACMS whose stated ranges exceeds 250 kilometers, and 300km respectively.

| System | Country | Est. Range | Primary Use | Delivered to Ukraine? |

|---|---|---|---|---|

| Taurus KEPD 350 | Germany | 400–500 km | Hardened targets | ❌ (as of Apr 2025) |

| Storm Shadow / SCALP | UK / France | 250+ km | Deep-strike | ✅ |

| ATACMS | USA | 300 km (M39) | Area targets / logistics | ✅ |

/ 2. Europe’s Changing Posture on Advanced Weaponry

Germany’s debate over Taurus is inseparable from wider European dynamics. The United States recently cleared ATACMS deliveries to Ukraine; France and Britain are supplying SCALP and Storm Shadow missiles, respectively. These moves represent a broader shift among NATO members toward granting Ukraine more robust offensive tools, despite fears of igniting conflict escalation with a nuclear-armed Russia.

From the vantage point of many Eastern European countries, backing Kyiv with advanced missiles signals the West’s resolve against Russian aggression. Germany, however, has historically taken a more measured approach—a posture influenced by legal caution, the country’s World War II legacy, and a deeply ingrained culture of arms-export restraint. Critics warn that if Berlin remains too hesitant, it risks appearing out of sync with NATO allies when unity is most crucial.

/ 3. Modernizing Taurus Amid Political Hesitation

Ironically, even as Germany hesitates to export Taurus to Ukraine, Berlin is enhancing the missile’s capabilities for its own arsenal:

- Bundeswehr Overhaul: A new framework agreement funds a second major refurbishment, ensuring Taurus remains operational beyond 2028.

- Industrial Investments: Saab recently secured a contract worth 1.7 billion kronor (~150 million euros) to modernize missile components, while MBDA Deutschland invests over 250 million euros in expanded production.

- Future Integration: Alongside deployment on Tornado jets, Germany is moving toward Eurofighter compatibility, placing Taurus at the forefront of the Luftwaffe’s precision-strike doctrine.

These parallel modernization efforts place Germany in a paradoxical position: it is developing cutting-edge capabilities for the Taurus but remains deeply divided over whether to deploy them in Ukraine.

/ 4. The Bundestag Push for Taurus, Scholz’s Caution and a (Potential) Merz-ian Resolution

Political fissures around Taurus deliveries came into sharp relief in late 2024, when the Free Democratic Party (FDP)proposed granting Ukraine the missiles. Chancellor Scholz resisted, citing escalation risks—his view being that a long-range system capable of striking deep within Russian territory could dangerously broaden the conflict. German technicians assisting with targeting might also be perceived by Russia as direct co-belligerents.

Scholz’s allies in the SPD generally mirrored his caution, maintaining that each arms-delivery decision should be weighed against the danger of crossing a red line with Moscow. Conversely, many politicians in the CDU/CSU and Green Party see advanced missile aid as vital to Ukraine’s self-defense and to reasserting Western deterrence - the position that Chancellor-to-be Merz is holding, too.

/ 5. Divergent Views in the Upcoming German Coalition

Those parliamentary debates set the stage for what may be the defining political alignment of 2025. With a CDU–SPD “black-red” coalition expected, the fate of Taurus hinges on a change at the top.

Olaf Scholz’s SPD, shaped by decades of anti-militaristic tradition, is wary of normalizing offensive weapons exports. But CDU leader Friedrich Merz has already voiced readiness to supply Taurus in tandem with allied moves—such as the U.S. giving ATACMS or Britain delivering Storm Shadow.

Merz’s rationale includes targeting Russian logistics hubs, like the Kerch Bridge linking Russia to the annexed Crimean Peninsula, should the Kremlin persist in bombarding Ukrainian civilian areas. “We must empower Ukraine to move from defensive to offensive operations,” Merz argues, reflecting a broader NATO consensus that sees advanced missiles as a means to force Russia onto the back foot.

/ 6. German Missile Industry, Taurus Production, and the European Sky Shield Initiative

Another piece of the puzzle is Germany’s defense-industrial base, which stands to grow as Berlin invests in next-generation missile and air-defense technologies:

- MBDA Deutschland’s facility in Schrobenhausen is boosting production for Taurus and Patriot GEM-T interceptors.

- These expansions coincide with the European Sky Shield Initiative, a collaborative project uniting 23 European nations to enhance air and missile defense.

- Germany’s forward-leaning approach in R&D for systems like Taurus underscores the tension between modernizing for long-term readiness and withholding exports in the near term.

Should Berlin finally opt to supply Taurus to Ukraine, it would underscore a dramatic pivot from mere modernization to active strategic use of its advanced platforms—sending ripples through European defense circles.

/ 7. Implications for Ukraine and NATO Unity

For Ukraine, Taurus could fill a gap in strike capabilities, complementing existing Western-supplied systems that may have shorter ranges or less penetrative power. By interdicting enemy logistics far from the front, Ukraine could disrupt Russian supply lines, degrade command centers, and potentially accelerate changes on the battlefield. Yet introducing a new, high-end missile system also raises the specter of Russian escalation, possibly even nuclear rhetoric.

Internationally, many see Germany’s stance as a litmus test for NATO coherence. If Berlin—Europe’s largest economy—remains reluctant, it could dampen the alliance’s united front. Conversely, a bolder German contribution could signal a reassertion of its leadership in European defense policy, especially under a new chancellor with stronger hawkish leanings.

/ 8. Balancing Deterrence with Escalation Fears

Critics of supplying Taurus to Ukraine cite:

- Escalation Risk: Russia has threatened a broader response if its “red lines” are crossed—including intensified missile strikes against Ukrainian infrastructure or cyberattacks targeting European logistics hubs, according to defense analysts cited by the Munich Security Conference's Zeitenwende Initiative.

- German Historical Context: Arms-export skepticism rooted in memories of WWII and legal frameworks restricting offensive military aid. Thus, while Berlin has delivered significant amounts of other military equipment to Ukraine, the Taurus has to date been excluded.

- Legal/Operational Uncertainties: Because the missile’s programming is sophisticated, German specialists would be necessary to ensure the system works properly in the field. For Scholz, this risked crossing a red line—potentially making Germany a “co-belligerent”. Yet defense experts, including Nico Lange from the Munich Security Conference’s “Zeitenwende Initiative,” counter that the Ukrainian Air Force could be trained to handle all aspects of Taurus independently.

Proponents counter that proactive deterrence can shorten the war. They argue that withholding advanced armaments prolongs hostilities, allowing Russia to inflict further devastation in Ukraine. Moreover, Ukrainian crews have already proven adept at operating complex Western systems, mitigating the need for direct German involvement in active targeting.

/ 9. A Fateful Decision Looms: Ukraine, German Policy, European Unity

Whether a Merz-led government will shift Germany’s official position remains uncertain. However, the underlying tensions—between the SPD’s traditional aversion to robust arms exports and the CDU’s calls for stronger European leadership—ensure that Taurus will remain at the center of defense discussions. Any resolution will have significant repercussions:

- For Ukraine: Potentially game-changing strategic options if Taurus deliveries come through.

- For German Defense Policy: A litmus test of how far Berlin is prepared to go in matching allies’ arms contributions.

- For European Unity: An indicator of whether Europe can present a cohesive front as it modernizes its collective defense systems in the face of Russian aggression.

/ 10. Conclusion: From Headline-Policy towards Zeitenwende-Policy?

The Taurus debate encapsulates Germany’s broader transformation as it navigates the largest European war in decades. On one side, Berlin’s historical caution and legal constraints have so far limited offensive weapons supplies. On the other, Germany’s commitment to modernizing Taurus—and leading in collaborative European defense initiatives—shows a readiness for more advanced capabilities.

Whether the new CDU–SPD coalition continues Scholz’s reluctance or adopts Merz’s more assertive stance, the outcome could reshape Germany’s role in European security - it might even be a step from a "headline"-policy-shift towards an actual "Zeitenwende".

Balancing deterrence with the risk of escalation, industrial ambitions with political hesitations, Friedrich Merz has decisions to make—one where a single cruise missile system, Taurus, has become emblematic of far larger choices about war, peace, and European defense.

Grosswald.org remains committed to delivering nuanced, expert coverage of defense and geopolitics in Germany and Central & Eastern Europe. This reporting used material from several sources and press agencies. As the Taurus debate continues, Großwald remains committed to expert, real-time reporting on European security, missile systems, and the policies shaping tomorrow’s conflicts.