France Loosens EU-Buy Rules to Boost Defense Innovation

France has confirmed allowing non-EU companies access to EU-funded defense incentives, signaling a compromise in the European Defense Investment Plan (EDIP). It now includes provisions for up to 35% of EU-financed incentives to be allocated to defense products from outside the bloc.

Shift in Strategy for EU Defense Autonomy

France has reversed its stance against allowing non-EU companies access to European Union-funded defense incentives, signaling a compromise in the European Defense Investment Plan (EDIP). The proposal, designed to enhance the EU’s defense industry, now includes provisions for up to 35% of EU-financed incentives to be allocated to defense products from outside the bloc.

This policy shift follows months of French opposition to including defense firms from the United States, United Kingdom, Israel, and Turkey. French officials had argued the plan should exclusively support European companies to strengthen "strategic autonomy." However, recent political considerations, including maintaining U.S. support for NATO and European security, have influenced a softened position.

France’s move reflects broader efforts within the EU to strengthen military readiness across land, air, sea, and space. Programs like the Dassault Albatros aircraft and SMDM drones are integral to France’s maritime security operations, bolstering its naval defense capabilities. Learn more about France’s maritime surveillance initiatives here on grosswald.

Concerns about Fragmentation in the European Defense Technological and Industrial Base (EDTIB)

The 65/35 funding split proposal, developed under Hungary’s EU Council presidency with input from France, Germany, Italy, and Spain, has sparked debate. Nations like Sweden, which rely on defense contractors with British ties or UK-sourced components, opposed France’s earlier position. The compromise reflects growing awareness of fragmentation within the European Defense Technological and Industrial Base (EDTIB), which the EU is addressing through initiatives like the EDIP and the European Defense Fund (EDF).

The proposal also includes provisions to exclude countries deemed security risks or in violation of EU principles. This ensures that participation aligns with the EU’s geopolitical priorities and its Common Security and Defense Policy (CSDP). France views the draft as a workable compromise, though negotiations are ongoing, and revisions are expected before it goes to the European Parliament in 2025.

Germany, a leader in defense innovation, has also been advancing its regional security strategy, particularly in the Arctic. Its updated Arctic strategy reflects NATO’s growing focus on strategic areas like the High North. Explore Germany’sArctic strategy and its implications for NATO defense here.

EDIP Objectives and Strategic Context

First introduced in February, the EDIP seeks to bolster Europe’s defense capabilities by:

- Expanding joint production and procurement of advanced European weapons systems.

- Improving the availability and reliability of critical defense supply chains.

- Enhancing cooperation among EU member states to reduce costs and increase interoperability.

The EDIP aligns with the European Defense Industrial Strategy (EDIS), which emphasizes reducing fragmentation and strengthening the resilience of Europe’s defense sector. Collaborative efforts under EDIP and EDIS aim to develop a more robust European Defense Technological and Industrial Base (EDTIB), integrating research and development with manufacturing.

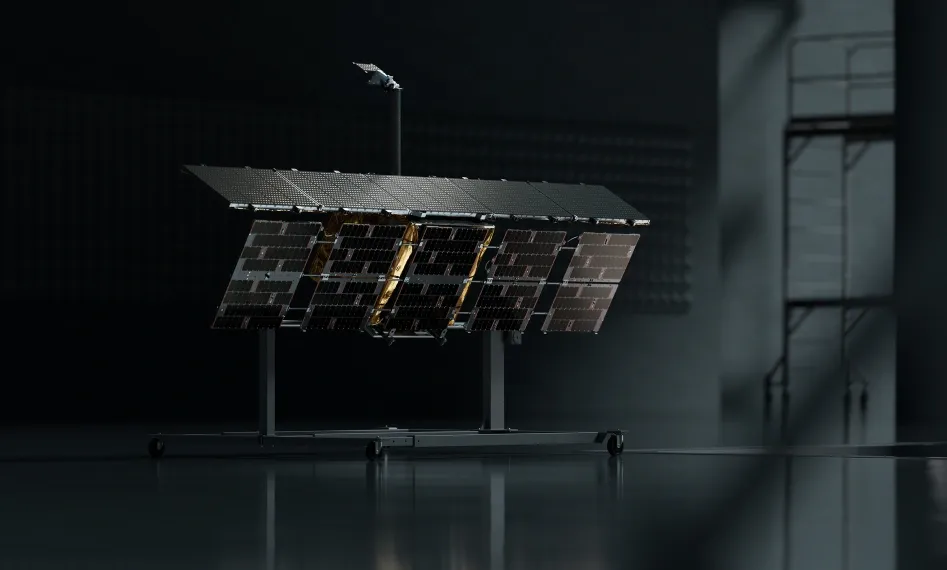

The program’s €1.5 billion budget through 2027 is expected to grow significantly, with member states advocating for additional funds under future EU budgets. Efforts to integrate Ukrainian defense manufacturers into EU supply chains demonstrate the bloc’s commitment to resilience and industrial scalability. Similar initiatives, such as the Rheinmetall-ICEYE Synthetic Aperture Radar (SAR) satellite systems, have proven effective in providing Ukraine with critical intelligence capabilities. Read more about Rheinmetall’s support for Ukraine’s defense here on Großwald.

Geopolitical Drivers of European Defense Policy

The initiative gained momentum after Russia’s 2022 invasion of Ukraine, which exposed vulnerabilities in Europe’s defense readiness and reliance on U.S. military support. Concerns about the United States shifting its security focus toward the Indo-Pacific, particularly under a potential second Trump administration, have prompted European Union member states to prioritize defense autonomy.

France’s policy shift aligns with broader EU collaborative frameworks, such as the Permanent Structured Cooperation (PESCO). PESCO enables non-EU nations to participate in key projects like Military Mobility, which facilitates the rapid movement of troops and equipment across Europe. Participants in this initiative include NATO allies like Canada, Norway, and the United States. These partnerships enhance interoperability and collective defense while maintaining Europe’s security standards.

Meanwhile, advancements like Germany’s PEGASUS surveillance system, which recently completed its first flight, highlight the increasing role of cutting-edge intelligence platforms in Europe’s defense strategy. Read about Germany’sPEGASUS system and its implications here on Großwald.

As EU nations increase national defense budgets and advance coordinated procurement efforts, these initiatives are positioning Europe as a more autonomous and strategically capable actor in global security. The EDIP, EDF, and related programs serve as pillars of this effort, balancing the need for European self-reliance with practical collaboration with trusted allies.

More articles on Europe: