ESA Bets €44M on Small-Launch Startups to Propel Europe’s Space Race

On November 19, 2024, the European Space Agency (ESA) announced a new policy initiative, allocating €44.22 million to support the development of small-launcher startups.

The European Space Agency's recent €44.22 million investment in small-launcher startups which is considered a significant injection into the forcefield of Europe's space launch capabilities. Moving from traditional service procurement to direct developmental support, this strategic reallocation, this has been announced on November 19, 2024, targets companies like Isar Aerospace, Rocket Factory Augsburg, HyImpulse, and Orbex. Ultimately positioning Europe to compete more effectively in the growing commercial space sector.

European Space Launch Autonomy: Strategic Context and Market Dynamics

The investment comes at a critical juncture when Europe faces increasing challenges in maintaining autonomous access to space. Following recent setbacks with the Ariane 6 program and the retirement of Ariane 5, Europe's dependence on non-European launch providers has highlighted vulnerabilities in its space infrastructure.

This situation mirrors broader strategic concerns about technological sovereignty, particularly relevant in the context of recent developments in defence policy such as around Europe's evolving defense capabilities and space-based assets.

Technical Specifications and Development Focus

The funding specifically targets crucial technical milestones in launcher development. Isar Aerospace's Spectrum rocket, designed to carry payloads up to 1,000 kg to low Earth orbit (LEO), features advanced composite materials and proprietary engine technology. HyImpulse's SL1 launcher, utilizing hybrid propulsion technology, aims to deliver up to 600 kg to Sun-synchronous orbit (SSO). Orbex's Prime vehicle, incorporating innovative carbon fiber composites and bio-propane fuel systems, targets the 180 kg payload class to LEO.

See Isar Aerospace's Spectrum in Action (Credits: Isar Aerospace)

Isar Aerospace Spectrum in Action. Source: Isar Aerospace

Market Position and Commercial Implications

The small satellite launch market, currently valued at approximately €5.5 billion annually, is projected to grow substantially over the next decade. This growth aligns with the increasing deployment of satellite constellations for communications and Earth observation, similar to developments seen in Europe's IRIS² constellation initiative.

“Europe’s emerging commercial launch service providers are pushing towards their first launches,” said ESA’s Director of Space Transportation, Toni Tolker-Nielsen, “we are very interested to see their rockets deliver, diversifying the European launch services on offer.”

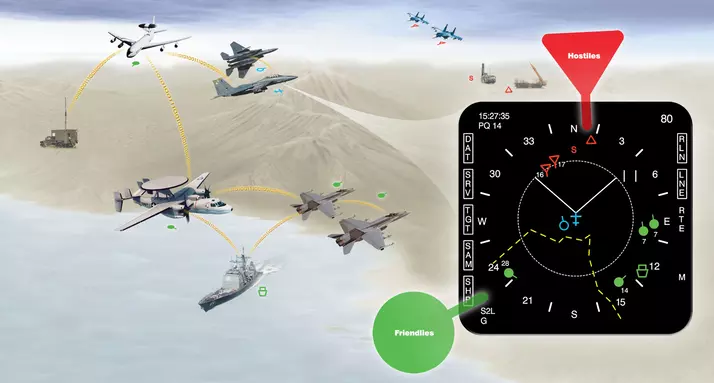

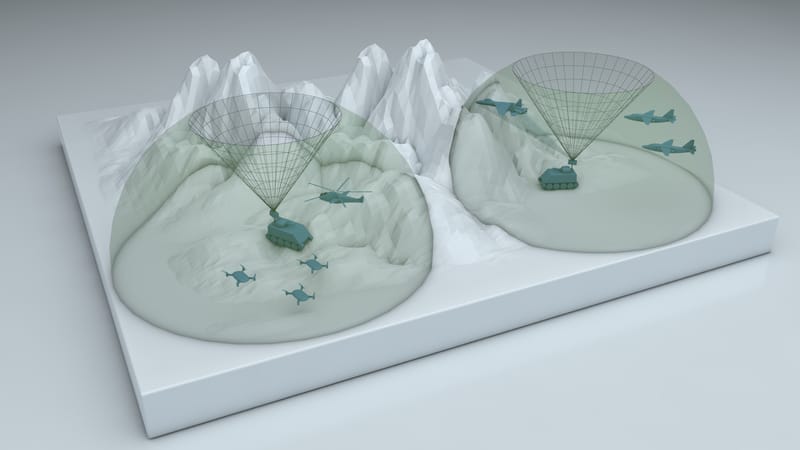

Integration with European Defense and Security Framework

The investment complements broader European security initiatives, particularly in space-based surveillance and communication capabilities. These developments are increasingly critical for modern military operations and strategic autonomy, as evidenced by recent advancements in European defense systems.

Technical Risk Mitigation and Development Support

ESA's funding approach for European launch vehicle startups is designed to mitigate technical risks and support development in several key areas:

- Propulsion System Validation and Qualification Testing: For instance, HyImpulse is advancing its SL1 rocket by developing a new hybrid engine, with ESA's support facilitating the testing and validation of this propulsion system.

- Structural Testing of Composite Materials and Tanks: The Themis program, supported by ESA, includes the development of lightweight fuel tanks and other structural components, emphasizing the importance of structural testing in launcher development.

- Integration of Advanced Avionics and Guidance Systems: HyImpulse's SL1 development focuses on subsystems such as avionics, with ESA's Boost! co-funding aiding in advancing these components towards integrated testing.

- Launch Pad Infrastructure Development: The UK Space Agency, through contributions to ESA's Boost! Programme, has funded infrastructure to support launches from spaceports like SaxaVord and Sutherland, highlighting the role of launch pad development in supporting new launch vehicles.

- Ground Support Equipment Qualification: In the initial Boost! co-funding contracts, ESA supported HyImpulse in developing necessary ground equipment to test critical subsystems of the SL1 orbital launch vehicle, underscoring the importance of ground support equipment qualification.

These efforts collectively aim to reduce technical risks and ensure the successful development and operation of new European launch vehicles.

Economic and Industrial Impact

While specific projections regarding job creation and economic multipliers for this particular investment have not been publicly detailed, historical data from ESA's previous programs can provide some context. For instance, assessments of the Ariane 5 and Vega launcher programs revealed Gross Value Added (GVA) multipliers ranging from 1.6 to 3.4, indicating that each euro invested resulted in up to €3.4 in economic activity. Additionally, ESA's broader space activities have been shown to generate up to €4 in economic activity for every euro invested, underscoring the strong performance of the space industry in creating additional value for the European economy.

In terms of employment, the Ariane 5 program exhibited an employment multiplier of 2, meaning that for each new job supported in the space industry, an additional job was supported in the wider economy. The Vega program had an employment multiplier of 1.2.

Given these precedents, it is reasonable to anticipate that the current investment in these European space launcher startups could produce similar economic and industrial impacts, including the creation of high-skilled jobs and a substantial multiplier effect on economic activity.

International Competition and Market Positioning

European small-launcher startups face established competition from companies like Rocket Lab and emerging Asian providers. The ESA investment aims to accelerate development timelines, enabling European companies to achieve operational status within 24-36 months. This timeline is critical for capturing market share in the rapidly evolving small satellite launch sector.

Future Implications and Strategic Outlook

The success of this initiative could fundamentally reshape Europe's position in the global space launch market. By supporting multiple companies simultaneously, ESA is fostering healthy competition while ensuring redundancy in launch capabilities. This approach aligns with broader European strategic objectives of maintaining technological sovereignty and security in space operations.

The investment represents more than mere financial support; it signals Europe's commitment to maintaining a competitive edge in space technology while ensuring strategic autonomy in access to space. As these companies progress toward operational status, their success will be crucial in determining Europe's future role in the global space economy and its ability to maintain independent access to space for decades to come.

More related articles on advanced energy & propulsion topics on grosswald.org: